Reality to be an interest rate administrator just how tough is the occupations?

have a glimpse at the weblink

Are a mortgage loan administrator are a challenging occupation, to be sure however it is and the one that also provides many benefits. When you are already financing administrator, you are aware your among the many people throughout the community since you functions directly that have readers just who dream of homeownership, powering their business, and a whole lot. And if you’re thinking about becoming that loan manager, be aware that it would be the advocacy and you may service that may let candidates complete the latest challenging travels off taking out a good mortgage effortlessly.

But what does a keen MLO’s go out-to-date look like, and just how hard would it be? Let us speak about a number of the pressures and benefits associated with the community.

Understanding the role out of an interest rate manager.

Home loan officials would be the side-up against experts who help prospective homeowners and you will entrepreneurs with procuring financing. These represent the intermediaries amongst the financial as well as the borrower, and they have a different sort of interest in supporting the borrower as a consequence of advocacy and you may possibilities regarding the some other mortgage solutions. They also make sure the lender’s conditions to possess financing approval is actually came across because of the borrower.

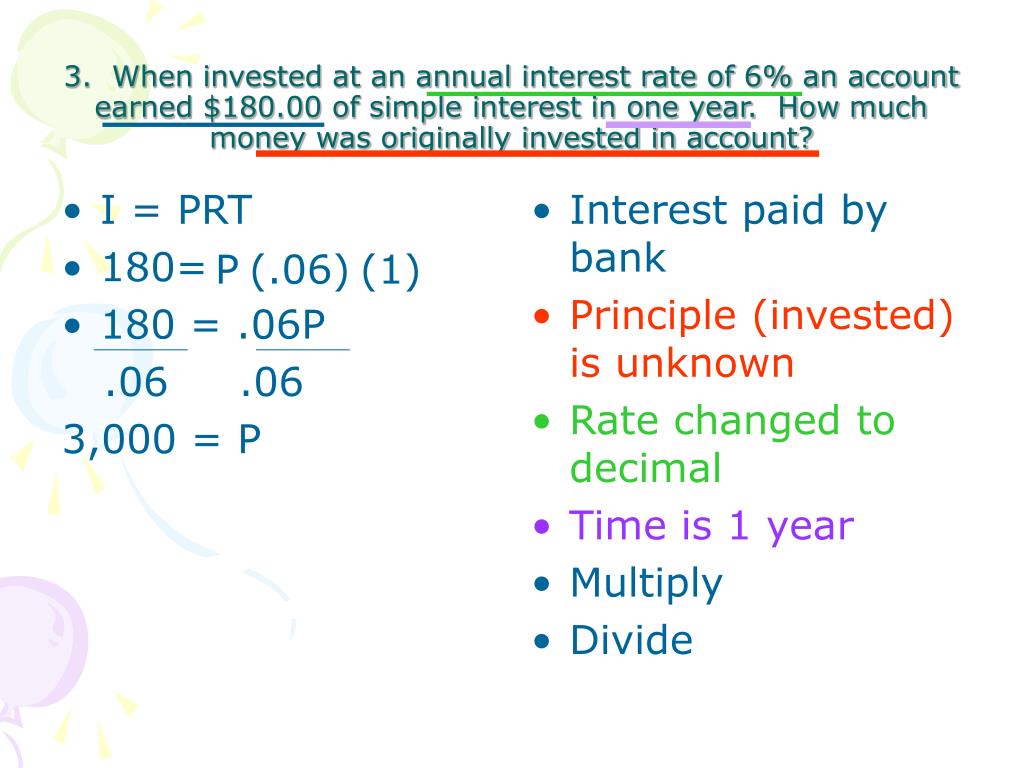

1. Buyer visit. Members seeking a home loan can meet to your financing administrator for an extensive session one reveals their profit, goals, and wishes within their search for a mortgage. In this procedure, the mortgage officer commonly remark its credit score, earnings, and you can debts to determine qualification.

2. Pre-acceptance regarding loan applications. Financing officers improve subscribers finish the financial application or other documents. However they let candidates collect all requisite paperwork. The borrowed funds officer commonly learn every piece of information and topic a pre-approval page having a recommended loan restrict.

3. Liaise which have underwriters. The loan financing officer communicates towards the underwriters to address questions otherwise assist eliminate any a great problems that could possibly get disrupt the fresh new recognition procedure.

cuatro. To generate leads and you will sales. Area of the obligations out-of a loan manager should be to actively search guides and you may new customers to grow its business. To accomplish this, they frequently have fun with social networking, network incidents, in addition to their relationships which have real estate agents.

As well as licensing as well as the commitments in depth significantly more than, because a loan administrator, you want a set of soft experiences to really master which job. Basic, mortgage world gurus should have finest-notch correspondence feel. There’s a lot out-of liability working in home loan origination MLOs who happen to be expert within its perform keep in mind that maintaining unlock contours from communication with interior stakeholders (e.grams., underwriters, administrator teams) is very important. You will also should be dependable, have solid time management experience, getting convincing, and you may know how to resolve troubles.

The newest day-after-day demands of being a mortgage loan officer.

Now that we have in depth the general part away from a mortgage officer, let us seem and their date-to-day pressures.

Time management and dealing with multiple customers.

Real estate loan officials is hectic. Between interacting with subscribers, analyzing home loan software, communicating with internal stakeholders, and you may sales, you must have a knack to own personal time management and you will handling multiple members with differing requires. As your organization increases, the trouble away from balancing all requirements only end up being more challenging.

Dealing with difficult website subscribers in addition to their requirement.

Becoming an interest rate officer are a help-depending world, so coping with anybody ‘s the chief component. Those in demand for a keen MLO’s characteristics are most likely on means of to make one of the biggest sales inside their life. This means the attitude, thoughts, and you can wants becomes increased, and some is quite manipulative if you don’t tough to bargain with. That’s where home loan officials can show their professionalism and you will commitment to ensuring that most of the readers have a good sense, inside your face out of impractical demands.