seven. Reviewing the mortgage data files and page of provide

After you’ve put the finishing touches on your distinct help data files and you will suggestions, it is the right time to complete and you will complete your property application for the loan variations!

Your representative typically plays a massive role at this stage, since they’ll certainly be able to make yes you have fully and you may precisely filled out the applying and connected all the compatible support documents.

Their agent might usually fill in the program for you, and sustain your printed into the any then interaction from the financial.

4. Searching conditional approval

If you’ve not yet compensated to the assets we wish to get, your own more than likely second step will be getting what is titled conditional approval’ or mortgage pre-approval’ on financial. A great conditional recognition signals that lender possess decided this may give you home financing but demands further information before making a final decision. It is far from a final otherwise authoritative acceptance, but rather an indicator that you are introduced their initial credit checks and you can creditworthiness tests.

It usually means that the lending company have reviewed the money you owe against the financing conditions and the sized our home financing you’ve applied for however, if you don’t nominate a certain assets you want to purchase, the lending company will not to able and come up with the best ultimate decision to the whether or not to give you money or otherwise not.

Conditional approval remains a convenient point to own even when, whilst mode you could attend open houses with certainty, understanding you’ve got financing pre-acknowledged along with your back wallet.

5. Possessions identification and you may valuation

When you find the appropriate possessions for you, the lender will have a specialist possessions valuer determine it so you’re able to determine each other their worthy of and risk online loan North Granby peak. To accurately measure the property’s worth, this new valuer will at things like:

- The amount of rooms, bathrooms and you can vehicles spots that the possessions features

- How big brand new land the house or property is on (if the home is a property otherwise townhouse)

- The quality of the brand new property’s structure and you can accessories, and additionally people structural defects or defects

- Entry to trains and buses and places.

The house or property valuation process can take a short while, dependent on valuer access and in case the vendor helps make the property available getting respecting. In the event your financial likes what they see they be during the exposure to the broker in the near future to give unconditional approval.

six. Finding unconditional acceptance

Following valuation of the home, if your financial was proud of the house under consideration and absolutely nothing regarding your financial predicament has evolved as you was considering conditional approval, might almost certainly present unconditional recognition on your mortgage.

As a result the lending company has now offered last recognition having your residence mortgage and made a formal commitment to lend your the money needed to choose the assets. Nothing’s legally joining but really, but you can think about your mortgage app effective at that part, while the approval process only about more than.

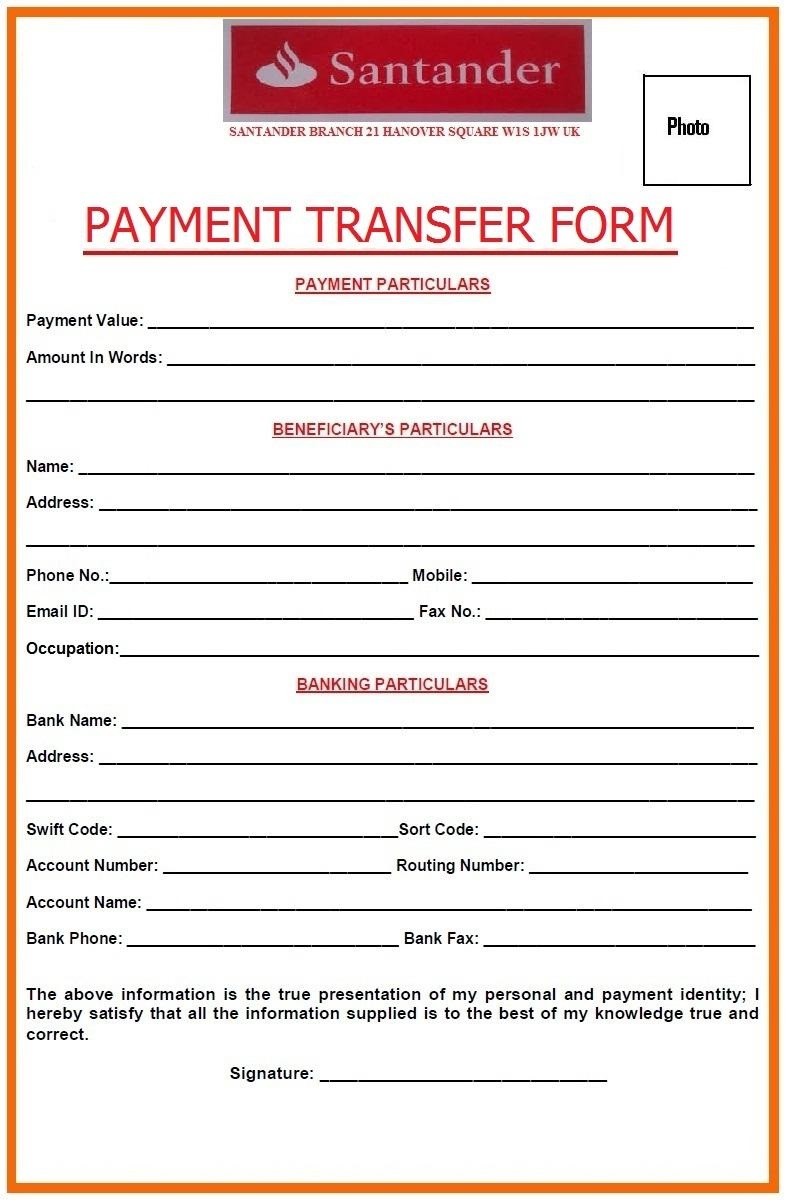

After providing you unconditional approval, the financial institution will send you the loan deal, help loan data files and you may an official letter out of give through your broker. Possible generally should study and feedback this type of thoroughly to help you guarantee that everything’s under control there commonly one undetectable nasties regarding bargain you might also like to get solicitor do this getting your.

8. Finalizing to your dotted range

As soon as your solicitor’s reviewed the latest records and you can offered you the thumbs upwards, it is time to complete and you can indication it all completely. Their solicitor will help to direct you through this processes, as well as your agent have a tendency to fill in the contract on the financial to your your own part.