Effective Labor Rate Calculator, Formula, and How To Improve

Labor mix variance is the difference between the actual mix of labor and standard mix, caused by hiring or training costs. Labor rate variance arises when labor is paid at a rate that differs from the standard wage rate. Labor efficiency variance arises when the actual hours worked vary from standard, resulting in a higher or lower standard time recorded for a given output. For workers paid an hourly rate, the cost formula is the hourly rate multiplied by the projected annual hours worked. Salaries paid to full-time employees or long-term contracts don’t fluctuate with changes in production levels. Whether the company produces 10,000 units or zero, this payroll expense remains the same.

Written by True Tamplin, BSc, CEPF®

A common reason of unfavorable labor rate variance is an inappropriate/inefficient use of direct labor workers by production supervisors. To calculate the percentage of sales allocated to labor costs, divide the total labor cost by the total sales. When all these factors are thrown into the mix, it’s clear that business owners cannot leave their estimates of labor costs to chance or quote jobs based on industry averages. If you want to achieve a certain gross profit margin for your company, you need to be able to start with your estimated costs and then add your desired markup. Labor costs account for, on average, 68.3 percent of an employee’s yearly salary or wages.

Tips to Reduce Your Labor Costs

For example, if your company’s roles require people with more knowledge and technical skills, you’ll probably have higher labor costs. Even if some of them are not visible to the employees, they are still costs that the company has to consider when calculating an employee’s labor cost. In this article, we’ll explore the labor cost definition, how to calculate labor cost, and how to reduce labor costs. Another strategy is to outsource jobs to different states or countries that are more cost effective. For example, the Canadian government pays for employee benefits. But keep that approach balanced — don’t forgo an excellent hire just because they require a higher state unemployment tax contribution, for example.

How to Save Time And Money With Automatic Scheduling For Employees

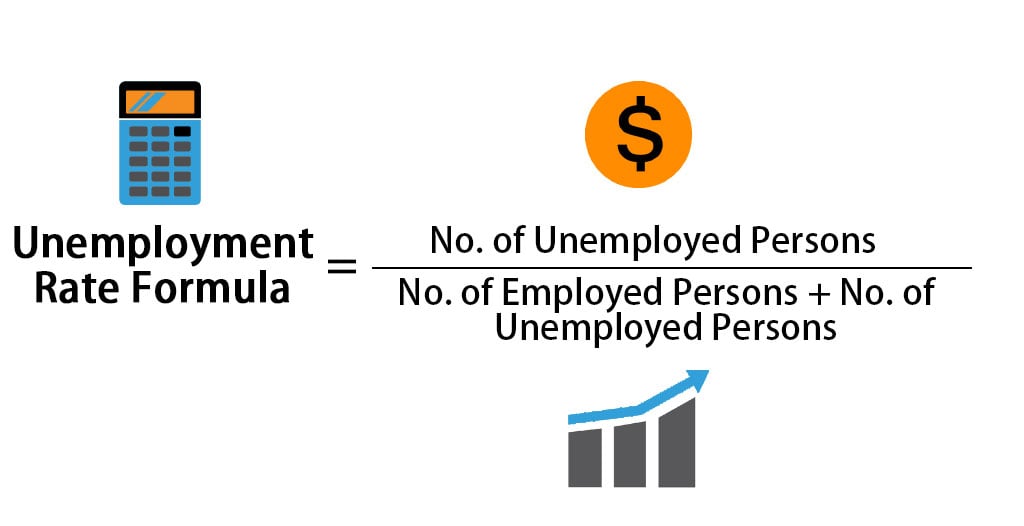

By plugging these numbers into the formula, you can find that your effective labor rate is $20 per hour. The average labor cost percentage should typically be in the range of 20% to 35% of a company’s gross sales. It’s not uncommon for restaurants and other service businesses to have a labor cost percentage of up to 50%. In other areas, such as heavy industry, the percentage should not be more than 30% to ensure profitability. A labor rate is the cost of labor that will be charged or incurred over a specific period of time. It is most commonly expressed as an hourly rate, but may also be quoted or calculated on a daily, weekly, or monthly basis.

What is the labor cost to install vinyl plank flooring?

- Divide the total monthly payroll cost by the total number of hours worked to find the hourly cost.

- Understanding these differences will help you effectively manage financial goals and operational strategies.

- Find the hourly cost of any fringe benefits paid to the employee.

That’s why we’re going to reduce the annual cost down to an hourly cost. Doing so will make it easier to work with, control, and, ultimately, reduce. This example only deals with one employee, but you can scale it up to accommodate as many employees as you have participating in manufacturing products or providing services. Absenteeism can occur for numerous reasons, including personal health issues, family needs, or poor job satisfaction. First, determine the cause and develop strategies to tackle the problem directly. For personal issues, remote or hybrid work arrangements can alleviate the situation, whereas poor job satisfaction indicates the need to strengthen company culture.

What is an Effective Labor Rate (ELR)?

When you determine your labor cost percentage, you can make a deeper analysis of your employee expenses. That’s how you can figure out if you need to reduce them to increase your free construction service invoice template overall profit margins. Losing sight of your labor costs can undermine your long-term growth. Just download our free spreadsheet and make tracking labor expenses a breeze.

Social Security tax is 6.2 percent of the taxable wages paid to each employee each year (up to $127,200 for 2017, a number that changes annually). Labor costs are a necessary expense to keep companies running, and employees should be fairly compensated for their work. However, even a necessary expense can be controlled using the right methods.

The total labor cost is then divided by the number of units produced to calculate the labor cost per unit. How much an employer pays in taxes per employee depends on the employee’s wages. For example, an employer with only part-time employees who work half the year can expect to pay figures in the hundreds, per employee. Taxes include federal unemployment taxes, Social Security taxes, Medicare taxes, state unemployment taxes, and more.

On top of that, there are unemployment taxes, which vary by state but can include state income taxes and unemployment insurance. To calculate a labor budget, you need to estimate the number of hours needed to finish the project and multiply that number by your hourly rate. Salaries, wages, and other compensation employees earn for a specific period that haven’t been paid by the company. By integrating with your source systems, Mosaic makes it easy to break labor costs down by indirect and direct costs, as well as per head and per department.

Instead of bouncing around from spreadsheet to spreadsheet, labor cost tracker to schedule, back and forth again, keep track of it all in one place. When you use When I Work, you can see your labor costs add up as you build the schedule, and get overtime alerts when someone is scheduled to work over their max hours. Labor yield variance arises when there is a variation in actual output from standard. Since this measures the performance of workers, it may be caused by worker deficiencies or by poor production methods.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.