Having 2022, the latest compliant financing restrict to have a conventional mortgage getting a single-tool home is $647,two hundred

Manufacturers will need to build its operations to keep up with alterations in have and you may demand. Therefore long lasting kind of a property we want to spend money on, there is absolutely no time such as the introduce.

Getting 2022, the new conforming mortgage maximum for 1-equipment house is $647,200

It restrict is decided of the Government Construction Financing Department (FHFA) and you can modified a year so you’re able to reflect the change in the average U.S. family rate. Keep in mind that large-prices areas qualify to own higher loan constraints. See for a list of 2022 compliant limitations for everyone counties along side You.S.

Having 2022, the newest compliant financing limit to own a traditional financial for the majority Fl areas to possess a-one tool home is $647,two hundred. When you look at the Monroe State, the newest conforming loan limit to own a-one-product house is $710,700 because it’s named a leading cost city. Check out to possess a listing of 2022 conforming restrictions for all areas across the U.S.

Quick to possess “Non-Qualified Home loan” and also have described as a profile mortgage, a low-QM loan is but one that does not comply with the requirements set by federal government in order to be permitted feel bought in the additional sell to regulators-sponsored agencies eg Fannie mae and you will Freddie Mac.

- Portfolio money

- Jumbo funds

- Financial report financing

- Alt-Doctor funds

- Zero money financing (DSCR)

- Advantage Oriented fund

- Foreign national fund (ITIN)

A good jumbo financing is actually home financing where in actuality the amount borrowed exceeds the compliant financing limit lay because of the Government Houses Financing Agencies (FHFA).

A portfolio mortgage is actually an interest rate that’s got its start by a lender whom holds the debt inside their portfolio into the lifetime of the borrowed funds in lieu of attempting to sell it from supplementary home loan market to bodies-sponsored companies such as for instance Federal national mortgage association otherwise Freddie Mac.

A portfolio financing can be used when trying to finance good assets that does not meet with the guidelines in order to be eligible for an excellent antique loanmon property versions that do not fulfill Federal national mortgage association and you will Freddie Mac advice tend to be, but they are not limited to help you:

- Bare home

- Condo-accommodations (Condotels)

- Farming functions

Additionally, a profile financing can be used because of the borrowers which have major borrowing from the bank points, shortage of documents to prove its money, or complex financials demands and you may needs.

Some lenders originate fund right after which promote her or him with the supplementary sector immediately after closing, a collection financial possess the mortgage within profile on https://speedycashloan.net/loans/fixed-rate-loans/ the life of the loan. Holding a loan within portfolio allows the lending company to set their particular approval criteria. Capable set an identical conditions once the compliant fund, otherwise they are able to carry out her conditions. Like, a profile lender may have a lower credit rating specifications, create various forms of cash verification/files, or more obligations-to-earnings ratios.

A no income mortgage lets real estate buyers to help you be eligible for a home loan without using tax statements

Yes! Local rental earnings can be used to qualify for a mortgage. The local rental income should be safely said into the Irs Form 1040, Schedule E. You must supply facts that local rental income does keep by giving present rent agreements.

As opposed to taxation statements, the new debtor need show proof of the brand new property’s cashflow. Lender’s utilize the Personal debt Services Exposure Ratio, that is a proportion out-of a great property’s operating income so you can debt maintenance having appeal, principal, and you may lease repayments to research just how much of money coming on the assets are often used to shelter newest debt burden.

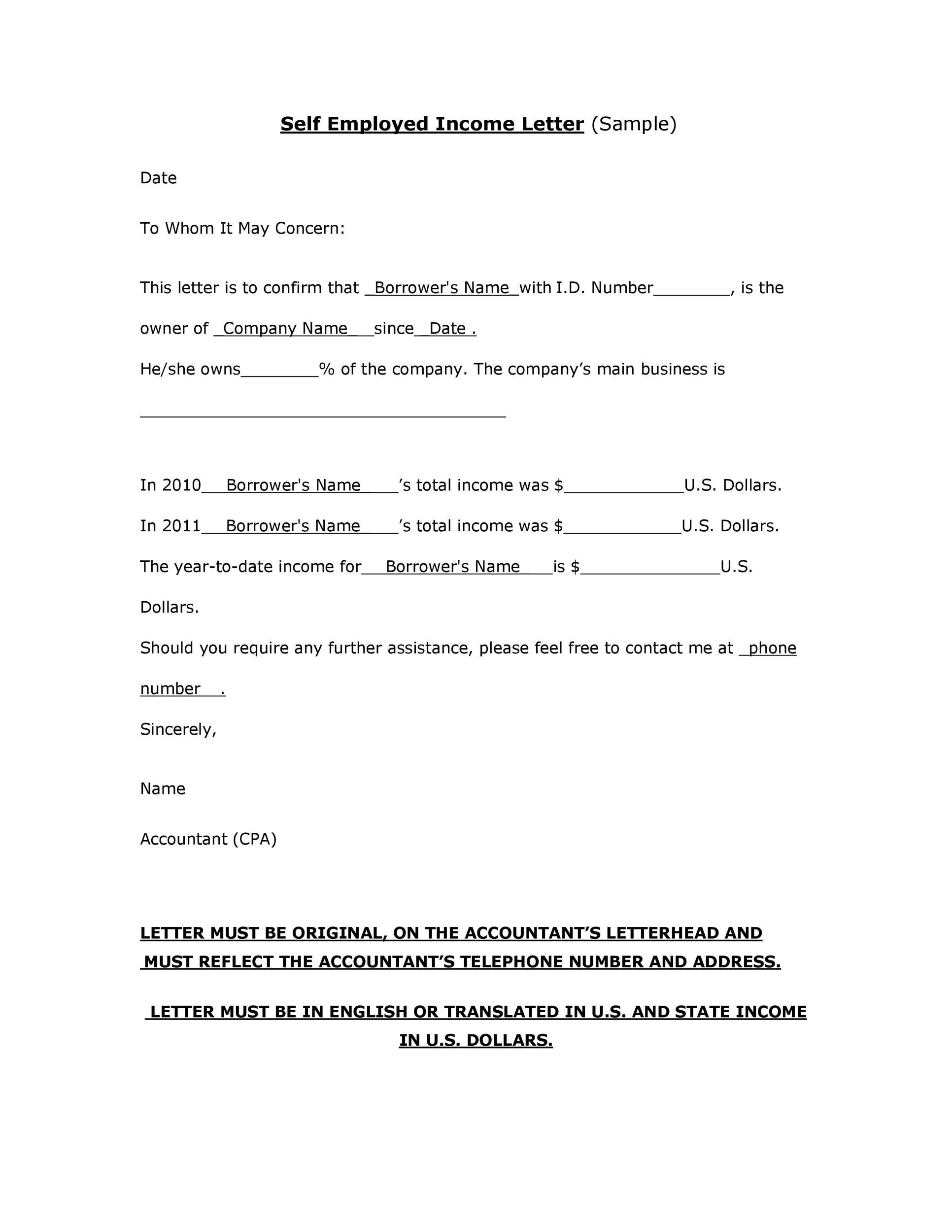

Known as a home-employed mortgage otherwise option papers home loan, a financial report mortgage was a non-qm financing which enables you to qualify for a mortgage as opposed to money records one a vintage mortgage would need including W-2s and you may spend stubs. These loan is a great choice for individuals who work with on their own otherwise own a business for example experts, small business owners, freelancers, solicitors, medical professionals, and real estate agents.