Pros and cons out of House Collateral Funds

Household Security Financing Qualification Requirements

Family equity money provide home owners the opportunity to make use of the brand new collateral they will have made in their residence, ultimately to be able to in fact have fun with their funding. These loans give monetary liberty, if or not to have home improvements, combining financial obligation, or investment existence incidents. Although not, like all financing software, consumers have to meet specific standards to secure these types of finance.

- Sufficient domestic collateral: Not absolutely all security try tappable security. Really lenders require you to hold at least 10-20% security yourself pursuing the financing, that gives a support but if home prices fall off. Put differently, because of this you can’t acquire the full quantity of security collected. Rather, you can just obtain up to 80-90% of it.

- Credit rating: The creditworthiness plays a giant role into the choosing the loan conditions and rate of interest. A good credit score, generally around 680 otherwise above, reveals a history of in control credit government and you will punctual costs, offering loan providers much more trust on your own capacity to pay off the mortgage. Griffin Financing need a credit score as low as 660, but just remember that , increased credit rating have a tendency to head to better cost and you may terms and conditions.

- Debt-to-money (DTI) ratio: Brand new DTI proportion was an effective metric loan providers used to check if you can afford yet another loan. They strategies the month-to-month debt repayments facing your own terrible month-to-month income. Lenders generally get a hold of a DTI less than 43%, whilst indicates a far greater harmony anywhere between income and debt. Yet not, Griffin Capital will accept good DTI as much as 50%.

- Loan-to-worthy of (LTV) ratio: LTV is comparable to the fresh security you have of your house and that’s determined by the isolating extent you owe on your own mortgage by property’s appraised worth. Such as for example, for those who are obligated to pay $150,000 and your residence is appraised from the $200,000, new LTV was 75%. Loan providers keeps a well liked LTV endurance and you will typically prefer an enthusiastic LTV regarding 80% otherwise down.

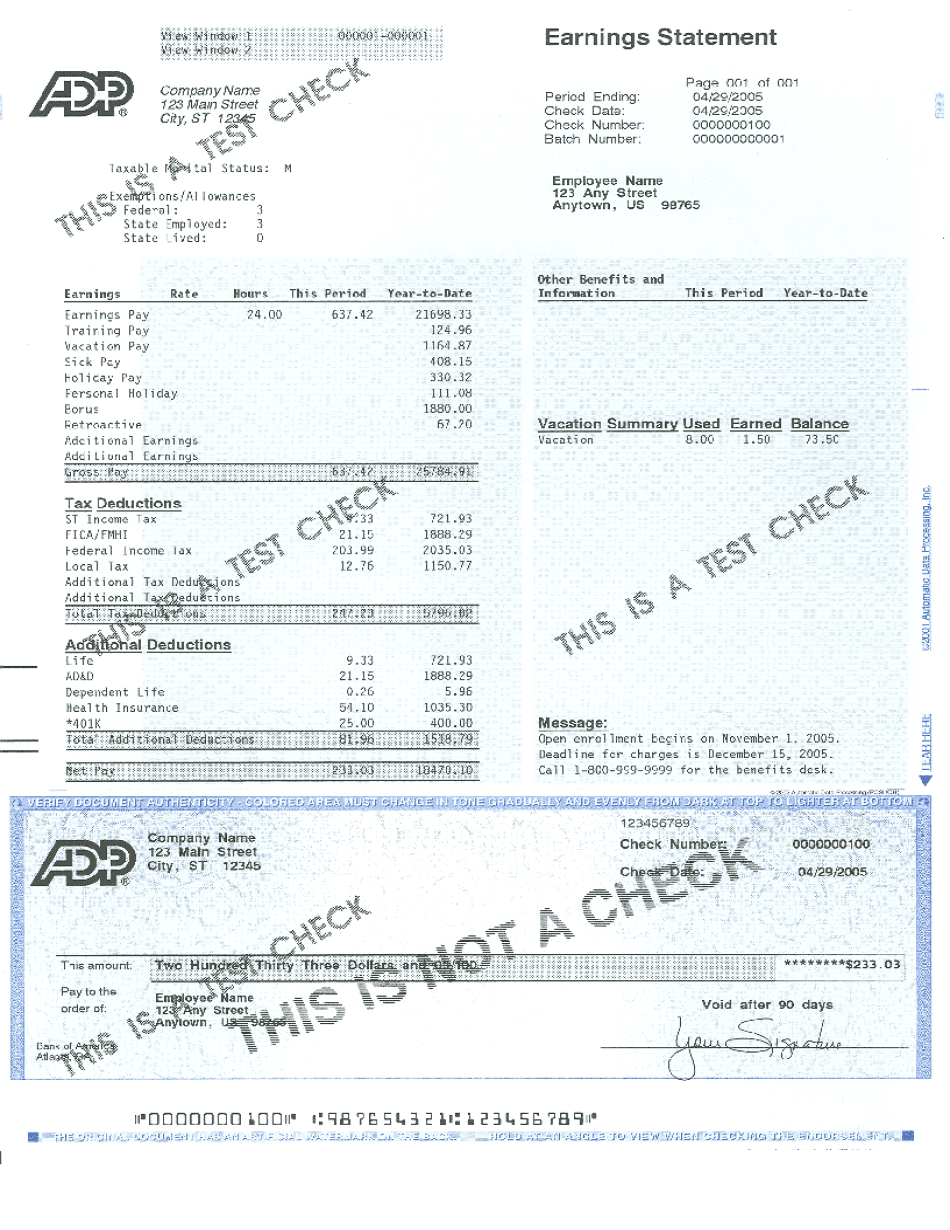

- Stable a career and you may income: Uniform income guarantees you could meet up with the monthly installment loans of a house equity loan. Loan providers commonly normally demand spend stubs, W-2s, and you may taxation statements to verify your own a position position and you may money levels. Folks who are care about-operating or has variable earnings you are going to face way more scrutiny and want to include most paperwork. But not, they could and sign up for a zero doc house collateral loan enabling these to qualify playing with solution documents. For instance, they may fool around with a lender statement domestic collateral financing that allows these to meet the requirements using twelve or 24 months’ value of bank statements unlike pay stubs or W-2s.

- Possessions kind of and you can position: The type of assets and its position may determine a beneficial lender’s decision. A primary house could have different collateral conditions versus an excellent local rental assets or trips household, with respect to the bank. Likewise, loan providers want to https://paydayloancolorado.net/hillrose/ make certain the funding are voice. Residential property that require high fixes or have been in areas likely to disasters have stricter loan conditions or perhaps ineligible to possess certain HELOANs.

Download the Griffin Silver app today!

Household collateral finance will be a means to fix many economic needs, out of high expenditures such as studies to help you debt consolidation reduction. However, as with any economic devices, HELOANs incorporate their number of positives and negatives.

Benefits associated with household guarantee finance

The largest benefit of a house equity loan is that permits that influence the brand new collateral you’ve produced in the domestic by paying off your dominating equilibrium. Most other benefits associated with these fund include the pursuing the:

- Repaired interest levels: Among the first benefits associated with family equity fund is that several incorporate fixed rates of interest. In the place of varying rates of interest which can be dependent on sector activity and you will can cause unpredictable monthly payments, fixed rates are unchanged across the loan’s name. So it predictability could offer balance and you may openness. Knowing the exact number it is possible to shell out per month normally improve cost management and you can monetary thought, deleting this new pitfalls of prospective price nature hikes.