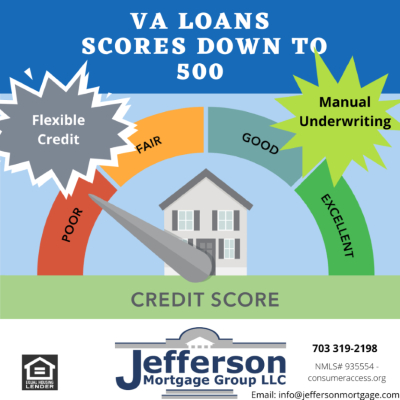

These types of loans was to possess acting seasoned armed forces solution users and partners who will be qualified

0% down-payment

Va loans to own mortgage loans, that are protected by You Service out of Experts Circumstances, do not constantly require a down 5000 dollar loan poor credit Woody Creek payment.

A new bodies-recognized loan that often means no downpayment are a great USDA financing. Speaking of supported by the united states Company out of Agriculture’s Outlying Development program and are usually having residential district and you will outlying home buyers one satisfy the income limits of your program.

3% advance payment

You will find traditional mortgage loans available to you which need as little as 3% advance payment. Some examples of this kind out-of financing include Household You’ll be able to and you will HomeReady.

As opposed to Va money and you can USDA finance, old-fashioned mortgage loans aren’t backed by the federal government, instead adopting the advance payment direction place of the regulators-sponsored companies (GSEs).

3.5% down-payment

Government Property Administration fund (FHA loans) want as low as 3.5% down payment, your credit score should be no less than 580. FHA financing wanted a good ten% down-payment when your credit rating drops between 500 and 579.

10% downpayment

Jumbo finance generally wanted a good ten% minimal downpayment. These financing, which can be outside Government Construction Finance Institution compliant mortgage limitations, can’t be guaranteed of the GSEs. Loan providers commonly wanted large down money so you’re able to mitigate some of the risks.

So you’re able to decide how much down-payment to make towards property, discuss with specialists in the loan globe. Here are some our very own Best in Home loan page towards the most useful brokers and you may mortgage benefits over the You.

How much is actually closing costs?

Closing costs will be costs getting features that helped in order to officially close the deal into the possessions. Normally, home buyers pays anywhere between step three% and 4% of the conversion rates in closing will set you back.

- a house evaluation repaid ahead of closing time

- a property assessment

- label insurance policies

- origination costs

- homeowners’ insurance coverage and you can taxes

The cost of domestic assessment-that’s constantly a comparable because household appraisal-is actually for a specialist to examine the property to recognize any facts or damages before you buy.

Our home assessment and also the house assessment could cost from $280 to help you $eight hundred. These two costs are basically the lender’s guarantees that the family is really worth the bucks you are being lent.

Other settlement costs like taxation, identity charge, and you will mortgage origination costs are usually a lot higher than simply review and you will appraisal costs. But not, those people large closing costs be hard to calculate simply because they differ according to where you are purchasing the possessions. They may cost 1% of transformation price of the home.

You can always pay a bigger first downpayment to take down their month-to-month home loan repayments and come up with they a reduced amount of good monetary weight. Spending more substantial advance payment than the standard 20% may signify to the family seller that earnings is stable. This may give you a bonus more other people finding a comparable home.

Even though 20 percent ‘s the generally accepted important having a down commission toward a property, this is simply not mandatory. You can make an inferior downpayment, and there is no minimum conditions to possess a down payment towards the property.

Actually, research by the Federal Association from Real estate agents revealed that the fresh new mediocre down payment manufactured in the united states to have property is actually 14% during the 2023, and not 20%.

Private mortgage insurance coverage (PMI) is amongst the main requisite after you create a down fee toward property below the basic 20%. Together with, while you are struggling with new downpayment costs, there are down-payment recommendations software provided by county and local governments that can help you.