Virtual assistant mortgage brokers offer larger advantages having helped millions of parents get to their dream of homeownership

Although not, it’s still projected you to only a portion of qualified veterans make use of funds protected of the U.S Company of Experts Factors. One commission could well be a lot higher. Let’s mention ten important facts about Virtual assistant finance in order to get the best financial service for your lifetime.

Licensed borrowers with complete entitlement and you may an amount borrowed higher than $144,000 will get purchase a house instead of an advance payment. Really fund, including FHA and you may conventional, need an excellent 3.5 percent so you can four % deposit. The capability to purchase property instead of a downpayment was a massive benefit to have army homebuyers that if you don’t had to scrape and you will stockpile consistently.

No private mortgage insurance coverage requisite.

In addition, you won’t have to pay month-to-month private home loan insurance rates (PMI) or policy for a “piggyback” mortgage to fund your own down-payment. Mortgage insurance policy is expected into the conventional financing which have a down payment off below 20 percent–generally, also, it is requisite for the FHA and you can USDA financing. No monthly PMI repayments suggest Va consumers is extend their to buy power and you may rescue.

Low interest.

Virtual assistant loans is backed by the government, that provides lenders confidence to extend advantageous rates. Indeed, Virtual assistant mortgage rates are often a reduced in the market. Mediocre 30-seasons Va financing fixed prices were lower than antique and you may FHA since the Ellie Mae, a loan application business, been staying song into the .

Informal borrowing from the bank requirements.

The Agency from Veterans Situations, the fresh company one oversees the Virtual assistant financing system, doesn’t set or impose the very least credit history. not, they prompts loan providers and work out a good judgments. Additional lenders may have some other standards whenever evaluating an excellent borrower’s risk, however, generally, minimal conditions would-be below those of antique mortgages.

It’s important to note–Virtual assistant fund are a lot more easy getting borrowers that rebounding out of case of bankruptcy, a property foreclosure, or a primary profit.

Forgiving debt-to-income ratios.

Your installment loan Edmonton KY debt-to-money proportion is the month-to-month debt payments separated by your gross month-to-month money. The fresh Virtual assistant it allows consumers to own people DTI ratio, in the event loan providers will normally want to see itat or less than 41 percent. Particular loan providers could go highest, according to your credit rating and other financial factors. Which freedom could help Virtual assistant individuals to expand the to get stamina.

Shorter closing costs.

One of the largest great things about a beneficial Virtual assistant-backed mortgage ‘s the reduced amount of settlement costs. The fresh Va it allows seller concessions but necessitates that vendor concessions create not meet or exceed 4% of one’s amount borrowed. Seller concessions range between:

- Prepaying fees and you may insurance policies with the household

- Interest buydowns

- The brand new client’s Virtual assistant money percentage

- Paying down judgments otherwise credit balances for the buyer’s account

- Gift ideas (i.elizabeth. a microwave oven otherwise dishwasher)

On top of that, the seller can pay the newest borrower’s closing costs that aren’t a portion of the cuatro% formula, including typical dismiss things.

Lifestyle work with.

Certified veterans which have complete entitlement can borrow as much as its financial try prepared to offer. This means that when it is for you personally to get a more recent otherwise large domestic, you could potentially sign up for a beneficial Virtual assistant financing once again.

- Have offered for ninety successive weeks in the wartime or 181 straight weeks in the peacetime

- Has half a dozen years of provider on the Federal Guard or Reserves

- Is the partner out of a service member

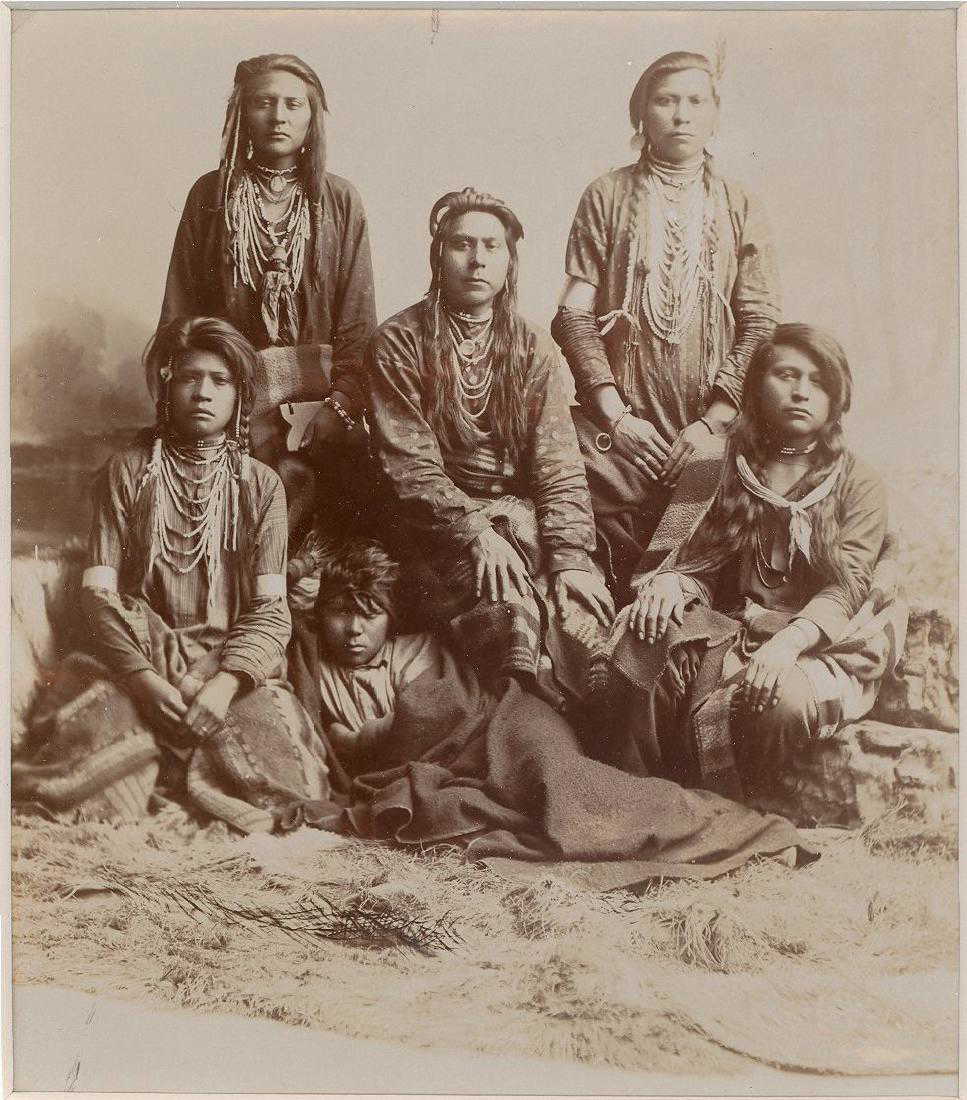

Enduring partners meet the requirements.

Va financing are available to surviving partners from armed forces users who died during energetic responsibility otherwise as a result of good service-connected impairment once they haven’t remarried. Enduring partners may also be eligible if an individual of those meanings is true:

- Its spouse try missing for action or try a good prisoner out of combat

Multiple financing solutions.

Specific pros is surprised to find out that there are various off Virtual assistant loan applications offered, each made to fit a certain you want.

Eligible consumers can use an effective Jumbo Virtual assistant mortgage buying otherwise refinance in the event that loan amount is higher than the conventional financing limits.

It is very important notice–Jumbo Virtual assistant funds require a down payment. Generally, the degree of down-payment called for for the a beneficial Va Jumbo financing is significantly below what is required towards the a conventional jumbo financing. Virtual assistant Jumbo money none of them mortgage insurance coverage.

Va pick loans try just what they seem like–a loan to get a home. The us government restricts extent and type of closing costs that can become energized.

An effective Va refinance* are often used to re-finance a current financing or several fund. Identical to with get purchases, the amount and kind out of closing costs that may be recharged with the experienced is minimal.

Interest Cures Refinance Loans (IRRRLs) was streamlined fund situated specifically for refinancing a home about what you’ve currently made use of their Virtual assistant financing qualifications. It will not need an appraisal.

Generally, an IRRRL lowers the interest rate into existing Va home loan. Although not, while you are refinancing out of a preexisting variable-rates financial to help you a fixed-price, the pace may boost. There is no cashback permitted to brand new experienced about mortgage proceeds.

You should notice–the latest occupancy need for an IRRRL differs from almost every other Virtual assistant funds. To have a keen IRRRL, an experienced has only so you can certify they’ve in past times occupied your house.

Virtual assistant individuals are unable to have fun with financing buying another household otherwise money spent and may approve that they want to inhabit the newest possessions given that an entire-big date living area. However, they may be able make use of it accomplish more than just pick an excellent household. Being qualified individuals can use the money so you can:

It is essential to notice–Lowest Assets Criteria need to be came across to help you be eligible for good Virtual assistant loan. These requirements make sure that pros and you will army group enjoys a safe home. It make up such things as hvac solutions, water-supply, and you can sewage disposal.

Might you Qualify?

When you’re a seasoned, reservist, effective obligation representative, otherwise enduring mate, PacRes has to offer a beneficial $1,111 bank credit towards all the Government Va finance already been November 1 owing to November 31. Find out more here or touch base to find out more.